How to Read Your Paycheck Stub

These are step-by-step instructions on reading your paycheck stub if you are an employee of NOCCCD.

Jump to Related FilesTo view your paycheck stubs, first login into MyGateway, and then access the Orange County Department of Education's Employee Information System (EIS), in the OC Dept. of Education EIS channel. The quick start guide, located in the same channel, has step-by-step instructions on how to set-up your username and password through the Orange County Department of Education.

A sample paycheck stub with annotations is available in the Related Files section below.

| Keyword | Explanation |

|---|---|

| Check Number | Employees who receive a check will see the check number in this box. Employees on Net Check with the Orange County Teachers Federal Credit Union will see the words "Net Check." Employees with direct deposit will see the words "Direct Deposit." |

| Sequence Number | Used by OCDE. |

| Federal/State Withholding Allowance | Information taken from an employee's W-4/DE4 |

| Message Field | This field provides an area for NOCCCD to place short messages and notices to employees. |

| Hours and Earnings |

|

| Tax Deductions | Employee portions of current and calendar year-to-date totals for Federal, State, SDI, Social Security and Medicare deductions. The current total of all tax deductions in this box will show in the Box 11 area as Tax Deductions. |

| Pre-Tax Deductions | A deduction taken from gross pay that reduces taxable wages. Examples are deductions for 403(b) TSA plans, deferred compensation 457 plans, Section 125 Cafeteria Plan deductions including Dependent Care. The current total of all pre-tax deductions in this box will show in the Box 11 area as Pre-Tax Deductions. |

| After-Tax Deductions | A deduction from an employee's pay that does not reduce the employee's taxable wages. This deduction is taken after all applicable taxes and mandatory deductions have been withheld. Examples are union dues, charitable contributions, and certain insurance payments. The current total of all after-tax deductions in this box will show in the Box 11 area as After-Tax Deductions. |

| Pre-Tax Retirement | Current, calendar year-to-date and fiscal year-to-date deductions for PERS, STRS, and/or an alternative retirement plan that is taken from gross pay and reduces taxable wages. The grand totals for current Gross Pay, Pre-Tax Deductions, Pre-Tax Retirement, After-Tax Deductions, and Tax Deductions will print in this area. Advanced Earned income Credit will show as a credit for employees who are eligible and have submitted a Form W-5. Classified employees who receive an Earned Salary Advance will see the amount of the ESA check they received on the 25th of the month as a deduction from their monthly gross paid on the 10th of the following month. |

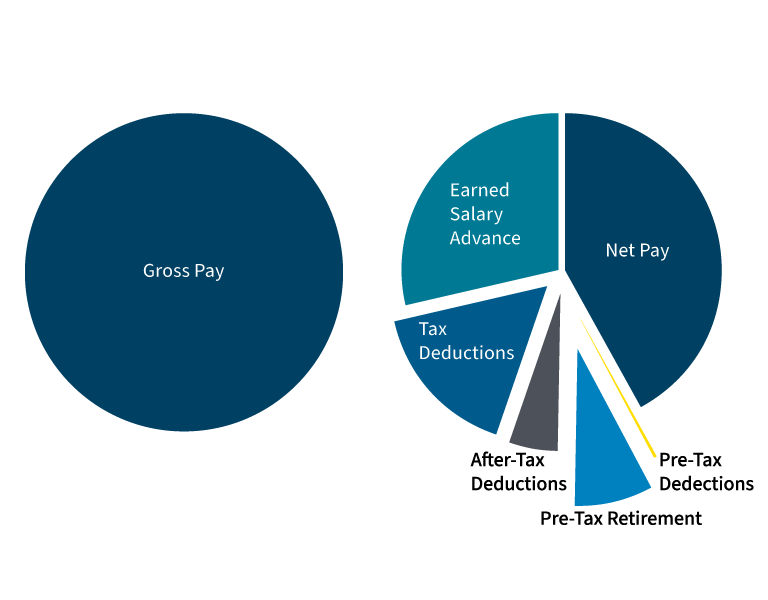

The Effect of Deductions on Your Net Pay

| Gross Pay | |

| Less | pre-tax deductions, pre-tax retirement, after-tax deductions, tax deductions, and earned salary advance |

| Plus | advanced earned income credit |

| Equals | Net Pay |